Source: John Foord Research

In April 2020, as the pandemic’s cases were rising around the world, I made a number of predictions and observations in a blog post on Covid-19’s impact on reinstatement costs.

Below, I recap my comments from April 2020 on Covid-19’s impact as the world entered the first wave of lockdowns and travel restrictions, and I have also added a column indicating what appears to have happened in a turbulent year for asset owners, insurers, reinsurers, and brokers everywhere.

To start with, my thoughts then on what might push prices down:

| My thoughts in April 2020 on reasons why costs could potentially fall | What appears to have happened during 2020 and into 2021 | |

| 1 | Lower oil prices could reduce raw material or operational costs. | Oil prices stayed at low levels of around $40 a barrel throughout 2020, only rising to around $60 a barrel in early 2021. The low cost of oil benefitted a number of sectors, but in reality this does not appear to have translated into significantly lower costs of raw materials or equipment. |

| 2 | Increased competition among suppliers for the lower volume of business could drive down margins. | Construction activity slowed drastically across many markets as movement of people and goods was constrained. Most suppliers were equally impacted and as a consequence there was not the imbalance that could have driven down expected margins. |

| 3 | Companies may have stockpiled in advance of the major impact on supply chains and could flood the market with products once business picks up. | In practice the opposite appears to have happened – with governments early on ordering the shutdown of non-essential businesses in Q2 2020, so stocks have been at record lows across many industries. |

| 4 | Suppliers may be keen to rebuild business or shift inventory after restrictions are lifted so could reduce prices to secure contracts. | With ongoing travel restrictions and huge variations between countries, it appears that, as at early 2021, most firms continue to be cautious. As mentioned above, many industries are experiencing low stock levels so firms have not been under pressure to drop prices. |

| 5 | Government support, e.g., through improved access to lending or staff support, could help contractors and suppliers to lower prices. | In practice, it appears that most governments prioritised job protection in their policies and there was no sign of any financial support for businesses causing widespread lowering of prices. |

| 6 | Continued uncertainty could mean that contractors keep margins low. | While the cost of materials and equipment appears to have held up during 2020, Covid-19’s impact was downward pressure on the cost of services, as firms and suppliers in these sectors tried to maintain activity levels. |

| 7 | Buyers may be keen to rebuild balance sheets so put off investment further, driving demand and hence prices down. | The latest commentary from central banks around the world indicates that they foresee continued challenges to economies throughout 2021. Accordingly, they see continued low inflation for the remainder of 2021. This supports the idea that prices should be under downward pressure but in practice the cut in capacity/production from suppliers has ensured that costs have remained stable. |

I also mentioned some of the reasons why we could see prices rise due to the impact of Covid-19. How have these projections turned out?

| My thoughts in April 2020 on reasons why costs could potentially rise due to Covid-19 | What appears to have happened during 2020 and into 2021 | |

| 1 | Increased costs in the supply chain due to delays, reduced capacity and increased border checks could drive up costs. | This certainly seems to have occurred with shipping costs alone appearing to have rocketed in the last 6-9 months. Firms in Europe have been talking about the cost of shipping a 40’ container from Asia going from USD 1,800 at the start of 2020 to over USD 10,000 by the end of the year. In terms of goods and commodities, while oil prices remained low, steel and other commodity prices have shot up in recent months. This has been driven by increased activity matched to the reductions in capacity due to shutdowns and historically low inventory levels. Steel mills for example were quick to idle furnaces but have been slow to bring this idle capacity back on line in many locations. |

| 2 | Manufacturers may shift more production to home (more expensive) markets to maintain consistency in supply chains. | There are few indications that this has occurred, mainly because of the widespread nature of Covid-19’s impact. However, this still remains a possible outcome of the disruption that has occurred. |

| 3 | Manufacturers may not be able to source raw materials as easily or quickly, so have to pay more and will pass this on. | As mentioned, some commodity prices have increased significantly in recent months and there is no questions this will have a knock-on effect on construction and ‘factory gate’ prices for goods. So far, inflation remains low and with capacity coming back on line perhaps the recent surge in prices will be short lived. |

| 4 | Companies in certain industries may have to pay higher wages to attract or keep staff. | Many countries are seeing unemployment levels rise, keeping downward pressure on wages generally. However, Covid-19 has created a new focus on digitisation and analytics for many firms and people with those skills are likely to be well sought after. |

| 5 | Weaker companies may go out of business meaning those suppliers remaining have more power to push prices up. | One consequence of the widespread application of government support across many industries is that most firms have been able to survive the impact of Covid-19 on revenues. However, as with any recession, the real impact usually hits as the economy starts to recover and we could still see this issue become a factor towards the end of 2021 and into 2022. |

| 6 | Increased protectionism may mean higher tariffs or barriers to movement of goods, services, or people. | During 2020 there was no obvious sign of Covid-19’s impact increasing application of tariffs and barriers. The change in the US administration at the start of 2021 may herald a new approach to international trade, reducing the prospect of further protectionism and tariffs. |

| 7 | Businesses that have laid off staff or downsized may need to invest heavily in training and restructuring, passing these costs onto customers. | With ongoing travel restrictions and huge variations between countries, it appears that, as at early 2021, most firms continue to be cautious. So, this issue could be a concern for the end of 2021 and into 2022 as markets come out of the current restrictions. |

So, what has stood out when considering what I thought might happen back in April 2020?

I suppose the speed of the impact of Covid-19, both on local industries as well as global supply chains, took most people by surprise.

The stop-start approach to lockdowns and restrictions has made it harder to decipher the systemic changes.

Certainly, the rapid price increase over the past year in the cost of transportation and commodities has caught many out.

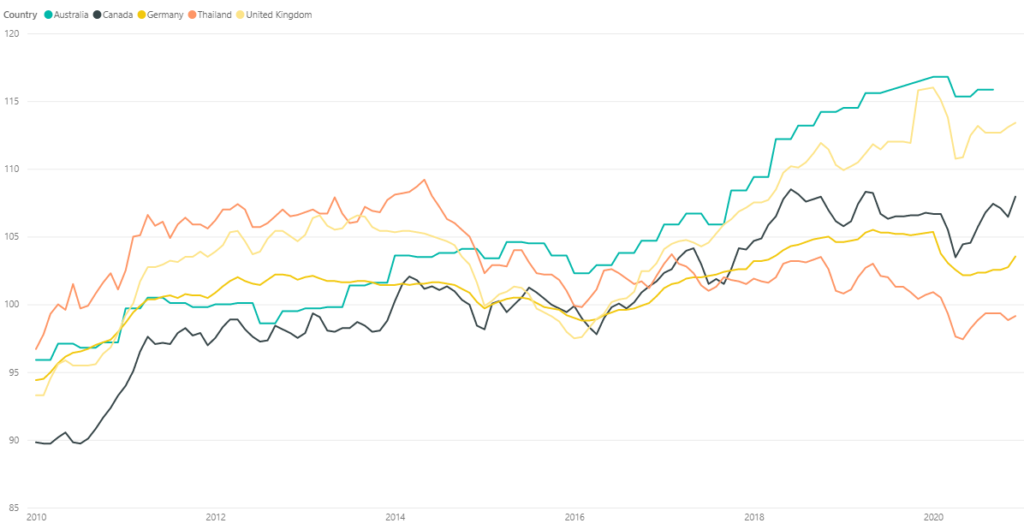

With US steel (hot rolled band) costs up 90%[1] over the last year, aluminium up 10%, and copper up 20%[2] from a low in March 2020, the potential impact on reinstatement costs for major facilities should not be underestimated.

Andrew Slevin

CEO